David Tepper

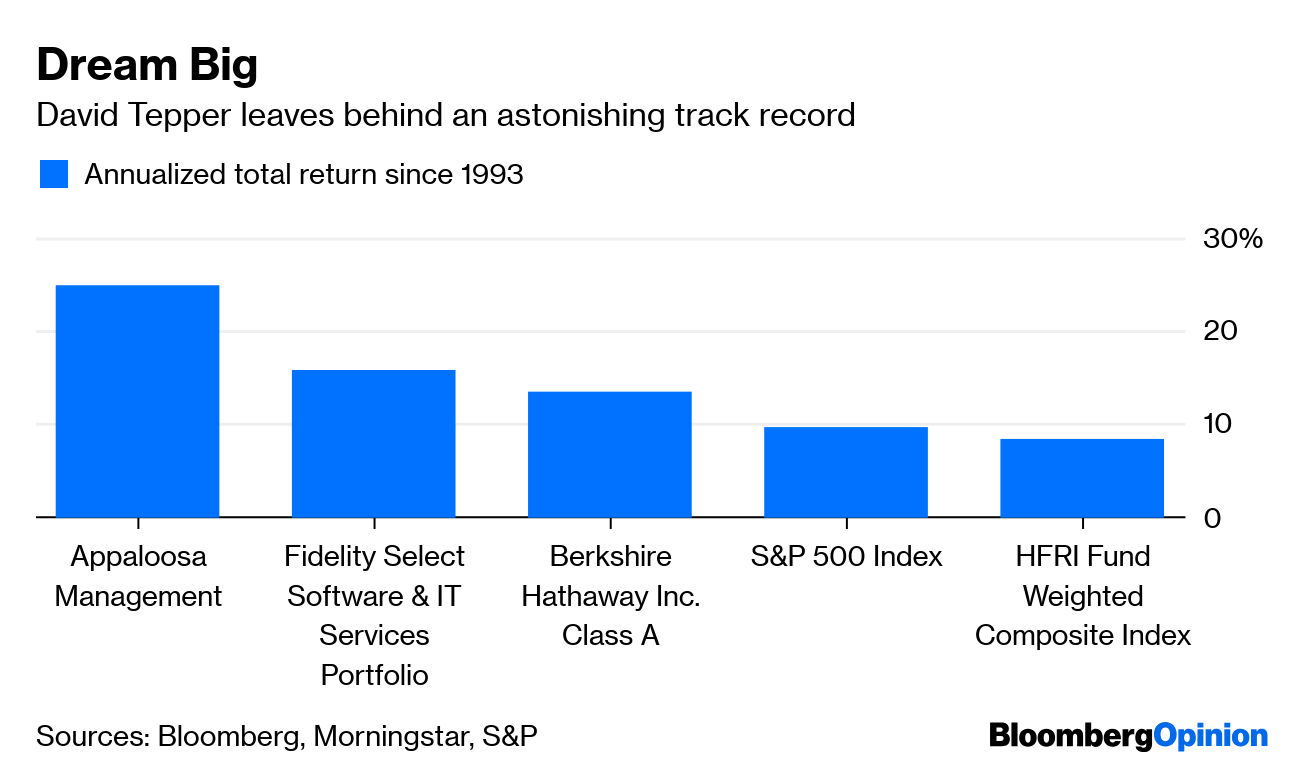

25% net of fees per year since 1993

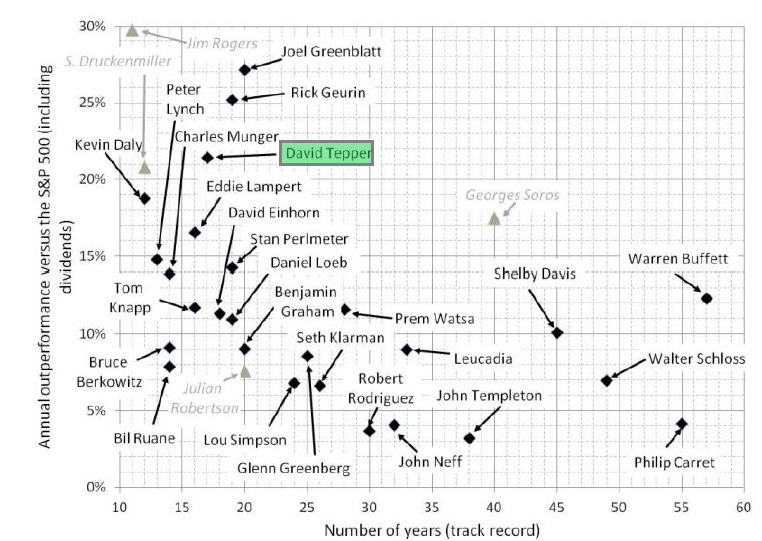

David Tepper is part of the small group of investors that managed to return more than 20% per year over a period of 3 decades.

$10,000 invested in his fund in 1993 would be worth roughly $3.6 million by 2019.

He now ranks at Nr. 109 on the Bloomberg Billionaires Index, with an estimated net worth of $16.2 billion, while his Fund manages $14 billion.

I'm just a regular upper-middle-class guy who happens to be a billionaire.

David Tepper

Appaloosa Management manages four investment vehicles:

Palomino Fund

Thoroughbred fund (Offshore & Onshore)

Flagship fund Appaloosa Investment

Palomino was ranked by Bloomberg Markets as the top performing fund of any hedge fund manager managing over one billion dollars.

Early life

David Tepper was born on September 11, 1957, in Pittsburgh, Pennsylvania. He obtained his bachelor's degree in economics from the University of Pittsburgh in 1978 and went on to earn his MBA from Carnegie Mellon University in 1982.

While pursuing his studies, Tepper devised a method for trading options that enabled him to generate income and cover his expenses.

Following his MBA in 1982, Tepper gained valuable experience working in the finance department at Republic Steel. This experience provided him with insights into purchasing distressed companies, which would prove to be beneficial in his future endeavors.

In 1984, he was recruited by Keystone Mutual to work as a credit analyst.

In 1985, he joined Goldman Sachs which is where David Tepper truly started to grow as an investor. Tepper joined the firm as a credit analyst, when the firm was establishing its high-yield group in New York City.

He quickly climbed the ranks and became the head trader within six months. For the next eight years, he focused mainly on bankruptcies and special situations.

Tepper played a crucial role in Goldman Sachs' survival after the 1987 stock market crash. He purchased underlying bonds in financially distressed institutions that had been severely impacted by the crash.

These bonds increased in value once the market recovered, and Tepper's actions are credited with contributing to the firm's successful rebound. Despite his significant contributions, Tepper was not made a partner at Goldman Sachs.

Tepper decided to leave Goldman Sachs in 1992 after being passed up on.

Performance and strategy

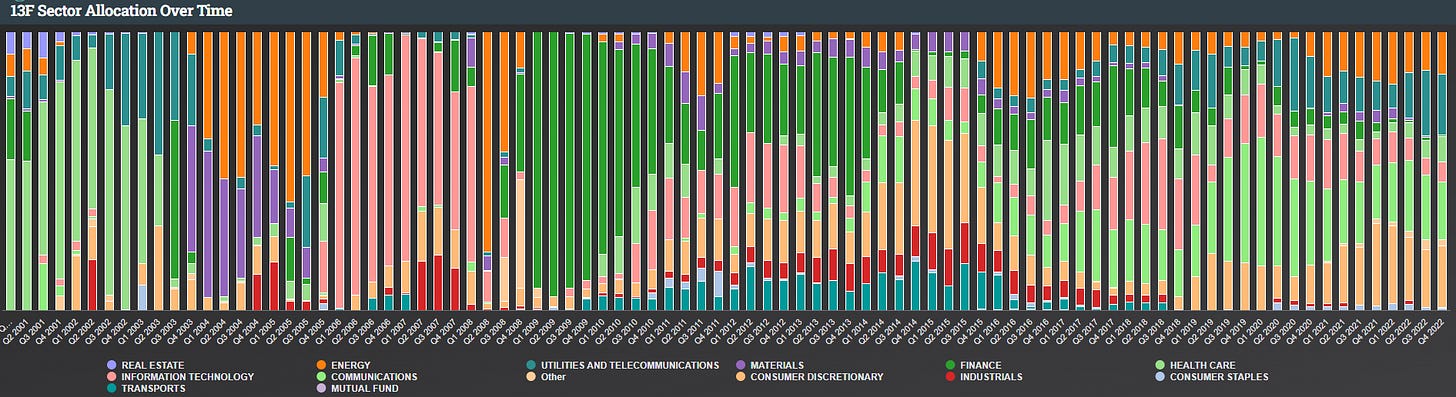

Appaloosa Management L.P. opened in 1993 with $57 million in capital and delivered a 57% return on its assets within six months. The fund's worth steadily grew, reaching $300 million in 1994 and $800 million in 1996. For the next 30y, David Tepper would continue to scale up the fund to $20b into 2014.

Appaloosa maintains its core in the debt trading which will become apparent through the performance around crisis. Day to day they manage a highly concentrated investment book.

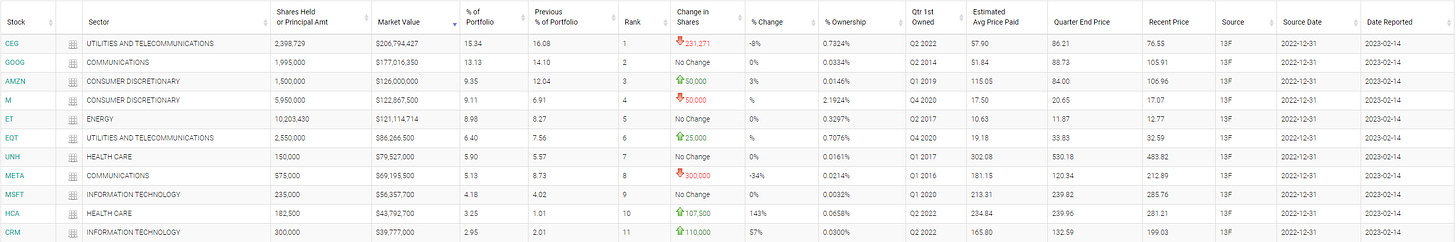

5 stocks make up more than 50% of the current investment book:

Tepper's expertise in distressed debt paid off, as Appaloosa made successful investments in companies such as Enron, Worldcom, Marconi Corp., and Williams Co. and more, profiting handsomely in the meantime.

“Very few people have gotten rich on their seventh best idea, but a lot of people have gotten rich with their best idea.”

Best performing bets

in 1999, Tepper bought back Russian bonds after the default in 1999 at five cents on the dollar. He made 61% on that trade making back his previous losses and even ended up positive on the Russian bond trade.

in 2008, he targeted major banks, Bank of America and Citigroup in particular, as rumors circulating that the banking behemoths would be nationalized in early 2009 edged the stocks to near collapse.

Tepper was able to buy Bank of America preferred shares at just twelve cents on the dollar and Citigroup bonds at just nineteen cents. As those stocks rallied by the end of 2009, Appaloosa raked in billions.

In addition to these investments, Appaloosa made a significant contribution to its success in 2009 by purchasing roughly a billion dollars' worth of AIG's commercial mortgage-backed securities at a price of just nine cents on the dollar. Known as the "AIG ace," these securities currently trade at approximately ninety-three cents and were a major coup for the firm.

Dotcom bubble and the 2008 financial crisis

During the dotcom bubble the fund prospered as many crashed and burned. In 2001, the fund was up 67 percent followed the next year losing 25 percent. In 2003 the fund saw 149 percent returns for investors.

Similar to the big bets he put on at Goldman Sachs in 1987, Tepper profited by the tune of $7 billion when the U.S. government intervened in the survival of the banks in 2008, returning 132% to investors.

Each time the fund was down 25% or more, the fund made back the losses within 6 months. 2 times out of the 3, Tepper followed with triple digits gains.

“We have this saying: The worst things get, the better they get. When things are bad, they go up.”

-David Tepper

According to Institutional Investor, Appaloosa has returned money to its investors in almost each of the past 10 years, as part of a longstanding policy of returning capital to maintain optimal returns. This approach has not been detrimental to Tepper's success.

Furthermore, Tepper had a talent for recognizing when to take calculated risks. From 1993 to 2014, Appaloosa's annualized standard deviation was seven times more volatile than the HFRI index, three times more volatile than the S&P 500, and twice as volatile as Berkshire Hathaway's stock.

"Investing with David is like flying, with hours of boredom followed by bouts of sheer terror"

Summary

David Tepper shines through as an independent thinker. In the same manner he was not fully accepted within the Goldman Sachs culture, he made his mark within the top investors.

He does not seem to be the most mathematical or special individual, but he truly shows what makes him one of the best when it counts. During crisis, when most shiver in fear, he is able to step up and show the conviction in his work.

Even more impressive is his ability to wait within the crisis itself. Even when all the investment universe shows a good value proposition, David Tepper is able to step back and think clearly until he is able to buy $1 for a few cents.

‘This company looks cheap, that company looks cheap, but the overall economy could completely screw it up. The key is to wait. Sometimes the hardest thing to do is to do nothing.’

I hope you have enjoyed this blog as much as I enjoyed writing it. David Tepper truly follows the pattern of the best performers, putting weight behind his conviction ideas and timing them right.

Let me know which other investors you would like me to study next!

This is really interesting! trying to study different investment strategies. some focus on minimal drawdown & steady returns. while either have a style which includes heavy drawdown with heavy returns.

Great article! I really enjoyed reading it. Appreciate the value you have shared. Enjoy doing research myself on successful investors, traders, fund managers and learning from them.