Fundsmith Terry Smith

This will become the document that encompasses all the lessons I learned from Terry Smith

Track record

Fundsmith is one of the best performing funds in the world. Since inception, the fund has returned a performance of 567.2% or 15.4% annually on average.

Fundsmith was up all years since 2011 apart from 2022 and bounced back with a 12.4% year in 2023 and so far 2.7% in 2024.

In the following chapters, I will go over the shareholder letters/meetings to create a timeline and crystalize the lessons Terry has been sharing since the inception of the fund.

For the shareholder meetings I will use and slightly edit the transcripts as well as all the information I deem to be noteworthy in order to create the best overview possible.

At a latter date, I will add the lessons I learned from Terry and his book as well and that way create a big document to learn from.

FUNDSMITH Annual Shareholders' Meeting 2024

‘Good evening ladies and gentlemen and welcome to the annual Fundsmith shareholder meeting it's good to see so many of you here I think we're even up on last year's attendance.

Good evening everybody it's nice to see so many of you here again. Don't expect me to say anything that you don't really already know because that's the whole point in many respects that we hope we communicate to you what we do and what we've done uh well enough for you to be able to stand up here and do this if you wanted.

I will spend a bit more time on performance than I usually do because I want to go through some background on that because I think it's quite important. I'm going to talk a bit about performance, a few slides, and then I'm going to go through the investment strategy again you know the strategy by now I hope we've made it quite clear from the outset what it is but really we tell you about the strategy so you can judge whether or not we're still keeping to it and one of the dangers of fund managers is so-called style drift they go off and do something else.

Last year we returned 12.4% there it is the market which is the MSCI in Sterling where dividends were invested 16.8% so we underperformed about 4% but we made some money which is nice, better than the previous year and there's January in there 2.7% up and I think February we're up about another 5% ytd.

More importantly I think is there's our long-term performance uh I know that some of you like me have shared in that which is good that's what we do have our eyes on we don't have it on a particular year or years even we we look at the long-term performance.

The sortino ratio over here (right column) which basically measures how much return you get for how much volatility there is in the unit price basically so it's a measure of to some degree at least of how much risk is being taken to obtain the returns because you can see some people who get great returns but the the degree of movement is considerably greater than than we've had.

We've outperformed it by about 4% During the period and the sortino ratio this measure of risk adjusted return is about twice what the market is which is kind of what what we're aiming for I suppose.

The only other thing to remark about here is last year bonds delivered a pretty decent return you know you uh you have to bear in mind when you're investing now whether you're investing with us or anybody else that Uncle Sam will give you 5% without any risk whatsoever and that's quite a a high bar for anybody to jump over in terms of a return. (US treasuries)

If you look at how funds have been selling in the last year or year and a half something like that the biggest selling funds are short-term funds in in fixed income because that's decent return.

What worked

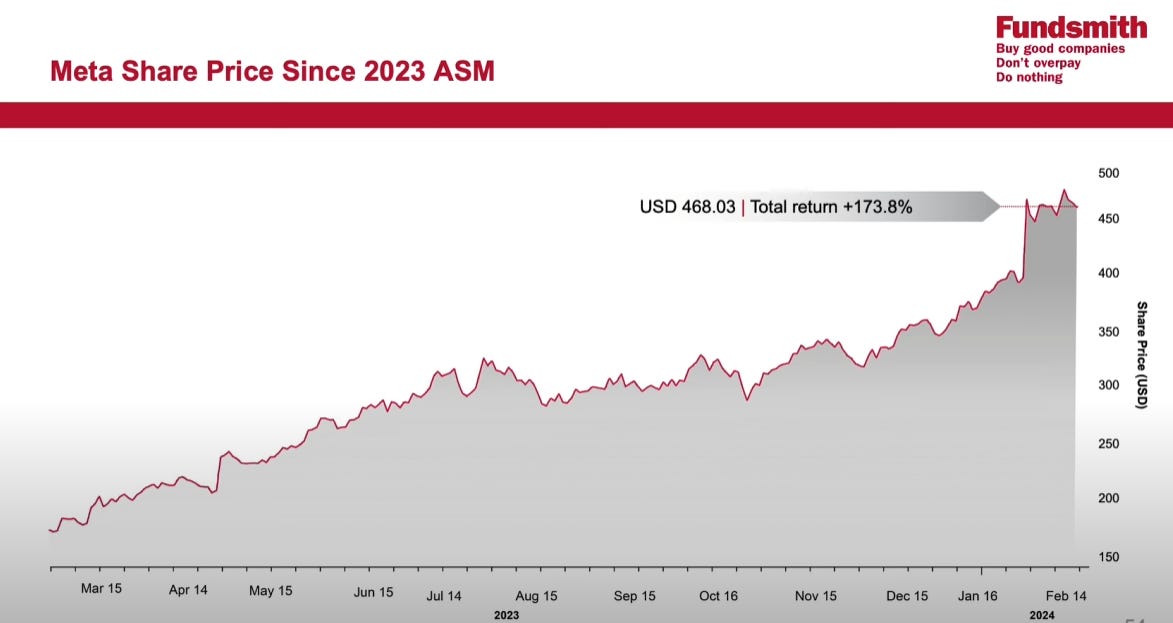

What worked and what didn't so the top five performers and the top five detractors show those to see what we can learn our biggest performer last year was meta platforms the old Facebook and if you read the annual letter you'll see that I say they're only half jokingly uh that I'm thinking of starting a new fund which each year will only own one share be a different share uh each year it will rotate into a new share each year and the sole the sole Criterion for that one share will be the one we get the most criticism for owning we got a barrage of criticism over over the the Facebook holding.

Microsoft was the second best performer you could say much the same about Microsoft if we look back to our annual meeting for the year when we bought it and the questions and comments there was a lot of criticism of us buying uh Microsoft at about $25 or $26 (Q1 2013( which is a long way short of where it is now which is 400 and something I can't remember exactly Junior knows these things better than me a more important point is this is the eth time that I've shown Microsoft in the largest contributors.

You make money with old friends you know if you've got something big like this that you get right the likelihood is it's going to continue to be right um I'm not a gardener but I'm told what you're supposed to do is water the flowers and pull up the weeds and awful lot of people do it the other way around they sell the things that have worked and hope hang on to the things which are are not working in the hope they'll come right.

Novo Nordisk if you hadn't heard of them a year or so ago I bet you've heard of them now this is the company uh which is the world's leader in the treatment of diabetes uh which came out with the first effective weight drug uh Ozempic. It is currently taking the World by storm not just in diabetes and weight loss but also its efficacy for other comorbidities for cardiovascular issues and I believe for treatment of kidney liver, Alzheimer's and autoimmune conditions like arthritis, lupus…

Novo Nordisk is actually making its fourth appearance in this table to give you that theme again um we own Novo Nordisk long before the words weight loss are ever used in association with it. What really attracted us was the the company's approach to drug Discovery.

L'Oreal, one of our favorite stocks as you know if you've listened to us before this is it second appearance in this table.

Idex Laboratories lastly this is the leading manufacturer of Veterinary diagnostic equipment and supplies in the world that's making its fifth appearance in this table. L'Oreal was one of our best performers and Estee Lauder was one of our worst.

What did not work

Estee lauder ran into a problem with having completely misjudged the China reopening and and the retail reopening in travel. As as a result it had a $500 million stock write off which is quite bad but more importantly we think exposed some real weaknesses in the supply chain that they had as well as some weaknesses in their management and so as a result we actually sold it in the middle of last year.

So it one it was our worst performer but it was gone uh in the middle of the Year actually and we don't think we'll probably own it again unless or until there's a change in in the fundamental management of the business

McCormick largest manufacturer and supplier of spices and condiments in the world they've got two businesses essentially one supplies retail and one supplies food service so restaurants particularly Quick Service fast food um casual dining restaurants with that split of business they had a very good time during the pandemic with cooking at home and a very bad time with restaurants.

Of course that's now reversed and the the restaurant business uh the food service business is smaller than the home retail business so the home retail business is now coming off some as a lot of businesses are some very strong pandemic performance and there's not enough in the in the food service business to compensate for that slight drag.

Secondly the food price inflation the input inflation has left this company with gross profit margins about three and a bit points 3.3 points lower than they were before the inflation and they haven't yet managed to catch up.

It seems their techniques for getting the price up to their customers supermarkets is not reactive enough, so little bit of a concern about that.

Next, you will see two drinks companies: Diageo and Brown Forman in these detractors the drinks companies generally are coming off a high during the pandemic when some people thought that people not going into work would leave people to drink less in fact they drank quite a lot more.

I'm not in the least bit surprised by that and that's obviously a high that they're coming off Diageo is also running into a particular problem, the downturn in demand in Latin America seems to have caught them by surprise as to how much stock was in their supply chain between them and the consumers in Distributors and Retail and bars. We are a bit disappointed by their control of their supply chain into distribution.

Brown Foreman is affected by the same pandemic highs in drinking and coming off it but there are no operational problems in it.

lastly Mettler-Toledo, this is the world's biggest manufacturer weighing equipment everything from your Supermarket scales through to things that can measure a nano-particle. It's used in Laboratories and bioprocessing and food processing applications. They also makes a lot of other things that go into that area things like pipetting equipment for bioprocessing and pharmaceutical manufacturer.

All the companies that supply stuff that goes into Laboratories are suffering from the same kind of detrimental things at the moment which is to say the coming off the covid purchasing high and so the comparatives are quite tough for them and the fact that China is not purchasing as much of this equipment as they were a year or two ago.

Mettler-Toledo has also got a a local problem which is they switched their Logistics base in the Netherlands from one supplier to another and managed to drop some orders in the process of doing it but we're pretty confident that will come back and that we're dealing with a high quality business so we're not all that concerned.

That's what worked and what didn't work.

More on Performance

I said a bit more about performance this year than I normally do because it's been a peculiar period with three consecutive years of underperformance.

For 2021, I'm inclined to somewhat ignore that year because we're up 22.1% and the market was 22.9%. If you want to give us grief for 22.1% let me know.

I'm more so really interested in 2022 and 2023 in terms of performance, where we did underperform. I'd like to talk about why because I think it's just to learn something out of out of that and see if um we can think about how we manage money and how you as investors trust us with it.

The 2023 performance was all about The Magnificent seven.

You'll see that the NASDAQ the US index delivered 43% return last year. These seven stocks delivered 2/3 of that return. If you didn't own all or most of these stocks it was close to impossible to outperform basically.

Looking at them we don't own any Nvidia and I know that um Ian (presenter) got a question for us later on about the um hype if that's what it is or the story around um AI which is driven this company which designs chips for the gpus which are use driving the the models for AI.

We don't own any that we do own some meta platforms we're never going to own Tesla. We did own Amazon and I sold it we'll probably doal with that a bit later in terms of how how good or bad an idea that one was we own Alphabet we do own Microsoft as well as some Apple.

We own a very small amount of apple and the reason for that is we started buying it a year and a half ago um when it was rated about the same as the S&P index. We thought if it's the same as the S&P index in rating we're probably right to own some.

We foresaw correctly that it was going to have a series of quarters of poor sales uh coming up it's had five or six in a row since we started buying the only thing we didn't fore is that the share price would go up 50% while that was happening so we haven't got enough apple or we didn't have enough Apple so you know that was one of that was the 2023 background to Performance.

2000 dot-com bubble

Everything has been done before basically it all gets rerun and the Magnificent Seven which they've used as this term for these seven stocks which drove the market performance last year.

In 1954 the 7 Samurai was released and the Magnificent 7 is clearly a copy of it. They just wear cowboy hats and carry guns instead of Swords so um so we have seen this movie before and you know the Magnificent Seven stocks we've seen this movie before in 7th of April 2000.

Goldman Sachs named their ‘super seven’: First Data, Oracle, Teradyne, PMC, EMC, Cisco and Dell. Those were the Magnificent Seven of 2000.

How did they do? How about the next 5 years performance?

‘History doesn't repeat itself but it Rhymes’

If we had on your behalf entered into a full blown let's own the Magnificent 7 last year we might eventually be into watching the sequel to it and with the same outcome basically um just to give you one other illustration this is about how this is a portfolio and um we have to be it's nice to own things that go up a lot it's great but you have to be a little bit careful about what you get on the way to them going up a lot and how it affects our decisions and your decisions. (META below)

Most importantly, a thing that a man said to me was you don't want 27 of these types of stocks because they usually all move in unison.

Company selection

Our stock portfolio universe is composed of 241 companies which we got from screening and these 241 companies are companies which have got market value of 15 billion or more so they're big enough for us to own and and they are companies which produced a total return over the 2022-23 period of 20%.

Why would you choose 20%?

It's 9.5% per annum compound that gets you to 20% over two years.

9.5% is actually the long-term average return on equities so these are companies over this period which were big enough to own and which produced the market return or better.

Why didn't we own them?

45 of them were energy stocks we don't own any energy stocks we're never going to own an energy stock. In 2022 if you did not own an energy stock it was just about impossible to outperform.

We don't own any energy stocks and we're never going to.(explained in his book). We don't own insurance stocks, we don't own very much in Industrials. Information Technology we're quite keen on.

Here's another reflection for you: You would have had to own the Magnificent 7 for two years instead of one to outperform. Remember the table above shows stocks that returned 20% returns or greater over the past 2 years. Out of the magnificent 7, only Nvidia made it into this list (1/7).

Looking at this, there's increasing signs there in my view of a fad.

Moving on, we've said from the outset we don't do feds Banks we don't do banks. Consumer services are right up our alleyway. we could have owned some consumer services stocks PDD, however we're talking about a Chinese e-commerce company headquartered in Dublin and listed in America no red flags there at all.

Financial Information Services we don't really do much in financials Aerospace and defense neither. Pharmaceuticals we own whereas we don't do building or mining.

Consumer products here's another one what we could do. We like consumer products but look at what the company are that perform well; Decker's Outdoors if you're unfamiliar with it this is the manufacturer of UG boots. My particular favorite is this the second best performing consumer product stock during the two years was Axon Enterprise.

Anyone know what axon Enterprise makes? consumer product tasers.

Basically, I am saying that this was a very very peculiar period in terms of performance. In light of the above, I think the fund performed well across the underperformance period.

Those two years you would have had to Owned energy and an awful lot of other garbage frankly and then had to reshift into the Magnificent 7. The last thing to say on that one is those businesses that you had to own to perform those mining businesses and so on, this is the Sturm business school of New York University publish this table pretty regularly and it's their examples of good and bad business.

They Define that in pretty much the same way that we do they take the return on Capital employed for the companies take off the weighted average cost of capital or whack which is just a guess on how much the capital costs so they get one minus the other and they tell you whether the companies make a positive spread when they take money from the market and do their business or whether they make a negative spread whether they're destroying value or creating value.

I'm shocked shocked(irony) frankly shocked Banks you know what Julian and I feel about banks(not interested at all) financial services ditto oil and gas no Air transport. Every time I fly I remember the mantra

‘the only two things you can achieve by owning an airline upset people and lose money’

Good businesses don't become bad businesses and vice versa. If you look at this data over many many years, such as 10 years of data here, they don't change very much. bad business do have their day in the Sun, the share price does perform for a period but they don't become good businesses that you want to own as a result.

The investment strategy

Our investment strategy our simple three-step strategy

Try to only invest in good companies

Try not to overpay

Do nothing

The Ratio

Every year we show you this this is our table of so-called look-through ratios take our portfolio calculate these ratios for it wait the result for each company to show its position in the portfolio and we give you the total number and we compare it with the indices.

Over time so you can see how it's changing we always talk about return on Capital employed as probably the biggest indicator of financial performance.

You can see last year 32% an all-time high for the portfolio but the indices whether it's the S&P about 17 or 18%, this means we're doing about 80% more than the index in terms of returns in our company comps. Keep those margins in mind when you get to the next set of slides which are on valuation.

Our companies are rarely going to be cheaper than the market, they usually are more highly rated but it doesn't make them expensive. It depends what quality you're getting.

Gross margin this is the difference between um sales revenues and the cost of goods sold is 63% which is pretty much in line with the long-term average.

To put it in English they're taking things in for 37 their inputs and selling their their output for 100 the index is at 45.

The index are taking things in that cost 60 and selling for 100.

It's better to buy something for 37 and sell for 10

0 than 60 and sell for 100 fairly obviously and also it's the big protection against inflation, when you get input cost inflation, the higher your gross margin the less you have to put your in price to reflect the the inflation and your input costs take out all the other expenses in a company you get to the operating profit margin.

You can see last year 29% again I think it's an all-time high certainly a high for the last eight years getting on for twice the index cash conversion this is a funny one not every pound of profits arrives in cash some of it goes into working capital in terms of stocks and payables.

Last year it was 91% it's a bit below the long-term average you can see is around 100 and it's recovered though from there our companies had a interesting time during the pandemic through shortages.

Finally interest cover though they've got debts and leases the profits provide a cover for that. How many times their interest Bill are their profits? you can see our company is 20 times.

Valuation

The FTSE(UK exchange) gives you a free cash flow yield of about 5.5%. It is rated at half what our companies are rated and there's an awful lot of debate about whether or not the foots as a result is cheap.

We're much closer to the S&P in valuation. you will see that the S&P500 trades at a FCF yield of 3.7%, we're a bit more expensive by about 20%. The question you and we have got to ask ourselves is is what we've got more than 20% better than the average in the index?

I would say YES.

Last year that free cash flow grew by 14%, that's a hell of a rate for companies of this size and part of that is their natural growth in sales and products, part of it is the recovery and that free cash conversion. I think is going to probably continue subject to no recessions or other interruptions through 2024 and that we're going to see pretty substantial growth in the free cash flow, which will make this valuation lower over time.

2023 Transactions

Here's what we bought and sold during 2023.

Why did we sell Adobe?

We bought Adobe pretty well during the downturn in 2022. It's a the world's leading maker of software for graphics. You all use PDF files I would think which is one of their main products. We bought it and it did well for us. Then they announced the acquisition of a thing called Figma which is a competitor. They agreed to pay $20 billion for it which is quite a lot of money in my view and they wouldn't tell us a number, not a single number.

They said they signed an NDA. which didn't allow it, which begs the question why did you sign that um anyway. Because it was a large private company we could get some numbers anyway and they were paying about eight times revenues for it which is a pretty stiff old price.

We thought it revealed a fundamental weakness that they had identified in their business that this competitor had achieved this and we also thought they were quite possibly not going to be able to cover that competitive threat by buying Figma even though they were trying to.

We thought the competition Regulators would be very anti a large tech company taking out a competitor given the way that things have gone in the tech sector in recent years um so we sold the shares.

Then they abandoned the acquisition paid a $1 billion break fee and the share price went up, so don't know I feel bad there we go right decision wrong outcome.

Why did we sell Amazon?

We bought Amazon when it was on its way down from the the highs of the pandemic and having basically extrapolated the growth in e-commerce demand and built facilities for demand that wasn't going to be there for the next year or two.

We've always liked the Amazon web service business so we didn't have to worry too much much about that and then the relatively new chief executive Mr Jassy made remarks about wanting to go big in grocery retail online, which in our view is disastrously stupid I'm afraid.

So we sold it. We may of course have done a disservice by being very vocal about that not that I overestimate or our our impact on anything in life but he hasn't actually done it so the thing we worried about hasn't occurred but we really don't like people who start saying they're going to do things which we think are a very bad allocation of our capital and your Capital.

Why did we sell Estee Lauder?

We sold Estee Lauder. We bought Procter and Gamble the world's biggest consumer Products company we've owned it before we sold it before because it kind of stored in growth terms the management didn't seem to understand you need to sell more stuff. They thought you could get there by just putting the price up as any of you who buy razor blades will have noticed in recent times um and we needed them to change that mindset.

Nelson pelts got involved and I think managed to change their mind about the need to have volume growth and they also did some very good things with regard to pruning the product portfolio.

They sold their food business which is not unnatural for them they're in personal and household care products. They sold the food business and they sold their beauty business which was disastrous for Cody and we thought that was they were really very good moves.

Actually we don't think that beauty businesses sit very well within fast moving consumer goods businesses we don't think they're good custodians. We think I think the best beauty businesses in the world have got family control stakes in them because they need to make decisions which only really long-term holders should do.

Why did we buy Marriott?

We bought Marriott. Marriott's the biggest hotel company in the world doesn't own any hotels or very many. It's a hotel franchise, it has Hotel Brands. If you're a real estate investor you can build a hotel, sign an agreement with Maria, put one of their brands on it and use their reservation and management systems and you pay them a a franchise fee.

It's an asset like model. They make great returns, as a result of that it's the biggest in the world and it's one of those areas where big really does deliver advantages.

They've got the biggest loyalty program in the world people come back to them as a result. The Loyalty program also gives them the biggest direct booking experience in the world. They have more direct bookings than any other Hotel Group which cuts out the need to pay fees to online travel agents saves them about 25 bucks a night in terms of cost to getting you into the hotel and they've got the best range of Hotel Brands and sites in the world. Super luxury through to economy through to Long stay which also attracts real estate investors who have to supply the buildings. If you're a real estate investor and you've got a good experience with Marriot in one brand you might just build something in another Marriot brand if you want to work with them and so that seems to work quite well.

Why did we buy Fortinet?

We started buying Fortinet. It is basically a duopoly in the area of cyber security they provide the 40 gate firewall system and the associated software. Their big competitor is Palo Alto networks. Fortinet was a company was doing very well, going along at 20% annual growth which was pretty good and then when people reverted to working from home during the pandemic they went to 30% per annum growth because lots of people like our it people had to come around and put a 40 gate firewall into my house otherwise I'd have lost all your data very quickly which you'd have been very upset about.

I suspect um and so they had 30% growth for a couple of years and funny enough if you have 30% growth when you normally get 20% you're going to come off that high they've gone back to about 10% growth and the market being what it is the share price perform very badly so we've started buying a stake in Fortinet.

We basically buy about a third of a stake every time they have a warning and that's what we're busy doing at the moment

Bottom line

All of that activity amounted to 11% portfolio return over last year, a bit higher than our normal, not the highest it's ever been still not a lot. The latest Morning Star data suggests that the average fund manager turned over their portfolio in the same period about 60%.

We got very low turnover. You can judge that by the costs, we spent 1.8 million on dealing on a 24 billion pound fund, that's 0.008%, just less than one basis point or 100th of a percent. We didn't spend a lot of money dealing and that I think is it for me.

Q&A Session

What is the team's view of the likely investment impact of a trump victory in this year's election?

Not a lot. Trump presidency for you in terms of its effect on the msci world index you can see that the president took office here and there he exited and over the period he was in office, the index grew at 12.5% compound annual growth rate which is about three points higher than its average.

As laid out above, I don't think he's going to have any impact at all really. I was just trying to think back to 2016 when uh Donald Trump was basically a twinkle in our eye in terms of Politics as to whether we'd actually discussed the likelihood of him winning and I think we probably didn't I think we nobody even considered.

Warren Buffett has actually been asked about it several times about what what is the role of the American president and he said:

The only role of the American president is to avoid getting into a nuclear confrontation other than that the American Tailwind Will Survive

The American Constitution has more checks and balances probably than any other constitution on Earth and therefore perhaps we shouldn't be too worried.

The investable universe for Fundsmith was around 75 companies, how many you look at beyond that and secondly, is Fundsmith being almost fully invested at times a drag on investment returns?

Our process: we want to find first off what are the good companies out there what are the companies that fit through our criteria our quality prism.

If you want to call it that in terms of the way the companies make their money the numbers their simple path to growth. So the first thing we do is is just look through the entire Market essentially over a certain market cap to find suitable companies. Companies that look like the sort of companies we want to own.

After they've gone through all the sort of usual research process end up being our so-called investable universe. We think of those as guard rails, because a lot of your other fund managers many of whom I'm sure have great results will be jumping around from Japan to Value to Quality to growth depending on what's In Style,

Our focus is on on identifying good companies and using that as our investable universe.

With that said the questioner quotes the number of 75 which I'm sure was right at the time it's now 85. We started out with about 53. We've got no particular limitation on the number of analysts we could employ if we could find more companies the more companies we can find the better because that's a a bigger roster to choose from.

On the question if we spend most of our time looking at the companies in the investable Universal or do we try to add?

The answer is both.

We have everybody do a bit of both, everybody's supposed to be both. I think the phrase is increasing knowledge on existing companies and also seeing whether there are any other companies out there some of which might have just been IPOed or been spun off which which fit the criteria.

Do you look at companies when they become cheaper?

We tend not to do that that's to go back to what junior said our first in terms of finding a new company do we actually want to own it never mind the valuation. We may find a company that we want to own which we never own I mean there are plenty of companies that we've been following for the last 14 years we have never owned it was rightly or wrongly we just didn't think it was the right time in terms of valuation and other factors to buy them.

First step, is this a good business? If we basically were able to own it would we like to own it that's where we kick off it on the second part of the question.

Is Fundsmith handicapped by being fully invested?

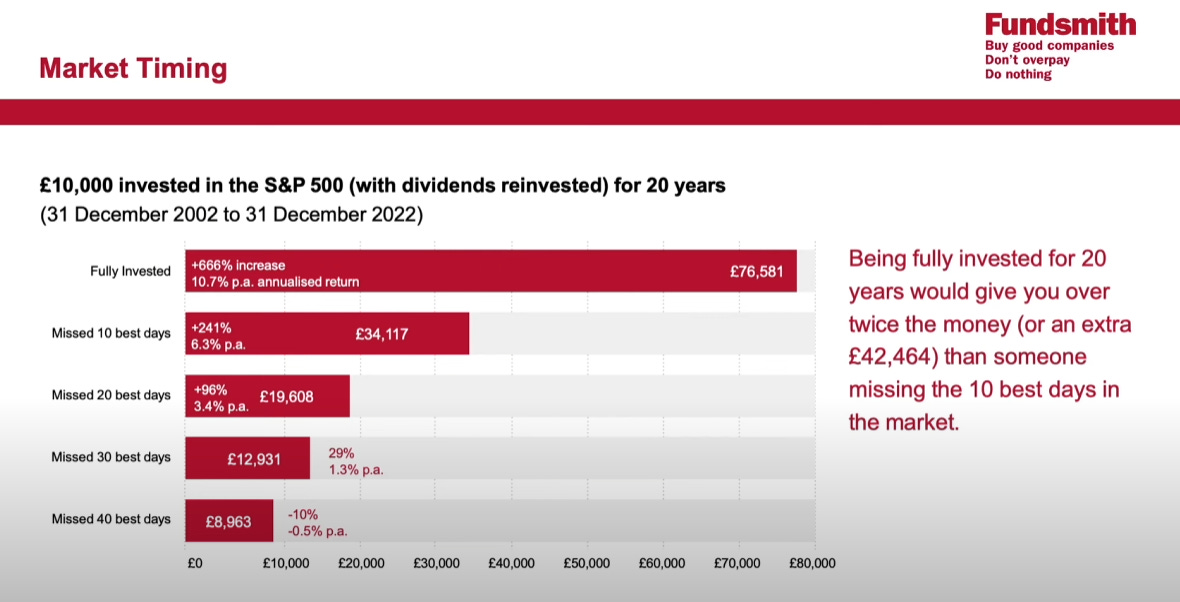

I think the answer is no. I just put up on screen for you this is the um uh the results for £10,000 invested in the S&P 500 with dividends reinvested for 20 years and it tells you what you would have got for a return over the years 2002 to 2022 so you know pretty recent 20 years.

If you had bought the S&P fully invested reinvested the dividends you would have got yourself a 10.7% annualized return. I was talking earlier about 9.5 over a longer periods of time.

If you missed the best 10 days in those 20 years, so one day every other year on average you would more than half the amount of your returns.

If you miss the one day in each year approximately the 20 best days you would have your returns again right.

If you miss the best 40 days so over 20 years, we're only talking about two days a year, you actually get a negative return.

We actually think the handicap that mostly you're going to get is if you try and Market timing and be in and out, because you don't need to miss an awful lot to take those returns down and also we don't feel we've got the skill to do it.

We don't actually think we know anybody else who's got the skill to do it either from what we see so are we handicapped by being fully invested? we don't think so.

If you want to be not fully invested you can do that you don't have to be invested with us all the time and or indeed you if you're with us maybe you've got other Investments you can you can manage your exposure to the market if you so wish.

The UK stock market is often quoted as trading at a discount to its International peers: Excluding those UK listed companies that you've previously invested in are there any other UK listed gems in your investable universe that could someday make an appearance in the fund?

It’s a common theme about the the UK stock market. We thought we'd do you a few slides on the UK stock Mark here's the the FTSE 100 by sector. As you know, we don't think there are very many sectors which produce the quality of returns that we expect and that we need to produce the returns for you.

How does the UK stock market the FTSE 100 break down?

Well we have 20 financials. Do you think we could get the sort of returns that we want out of HSBC, Lloyd's bank and the LSE? I doubt it.

Consumer discretionary we're quite interested in. That Flutter doesn't strike me as the quality of company that we would normally go for. We have owned IHG, it's not bad company.

Industrials, there's not much we like, Compass is not a bad business I think, but I'm not even sure it's an industrial. I think the labeling there is a bit odd.

Consumer Staples, we do like. We own Unilever, we own Diageo. we don't own BAT.

We won't own materials and neither will we own Communications.

I mean if you look at the share price performance of things like Vodafone is a tragedy (Debt/Leverage too).

Healthcare, we do own. We own both drug companies and medical equipment and devices companies but none of these make the cut. None of them are the kind of businesses in terms of return that we seek in terms of their financial results or their Market positioning.

We wouldn't ever own utilities, energy or own real estate.

We do like technology and we have owned Sage. We might own it again, I don't know and RELX is probably the other one that we would be interested in.

I would imagine most people in the room, live in the UK so they get very interested in it UK-based companies and its index. Its significance in World investment terms however, is not that great.

We put another stock on this slide just to further illustrate the point. That's the market capitalization of the footsy you can see they're just over two trillion pounds that's the market capitalization of Microsoft.

It's actually quite a lot bigger. You can read what you want into that in terms of valuation or everything else it's just a fact that Microsoft is. It's a big wide world out there we don't need to worry every day about the footsy. We could put the entire fund into Microsoft and have a 1% position in the company just to put it in perspective.

Looking at the quality of what you get other than just by sector, specifically focusing on return on Capital employed, one of our very very important performance metrics there only five companies in the FTSE 100 that have got higher return on Capital than us.

The three sort of permanent members are Right Move, Intercontinental Hotels and AutoTrader. Two more are Next and Centrica which appears to be on a free cash Le of of 47%.

Centrica had a funny um had a funny year, in a good way in 2023 and and thus because that is the numeration I actually included it, so those are the five but I would say that in most years it's going to be either three or four.

Half of the FTSE 100, 49 of them have got returns below 10%. That's never going to make it for us.

You need to be careful about cheap. Remember I said we've got a free cash flow you 3% on our portfolio and the FTSE with its 5.5% looks cheap. Averages are funny old things aren't they, because they can be distorted quite easily by some very big participants.

Lets have a look at that some of the companies that contribute to that 5.5% average the free cash flow yield.

Vodafone is at 20% FCF yield, on Centrica it's 47%, on International is Airlines it's 30%. There's some big distortions caused by companies with massively low ratings and when we do these free cash flow yields we don't include financials in the calculation because they don't the free cash flows are not really meaningful.

In finance, particularly in Banks, investors could look at return on tangible Equity, because if you look at Capital employed in the bank you get some very strange numbers. That is because of what banks basically do.

They have five of capital I mean I'm making the numbers up but they're not that far out five of equity Capital, 100 of liabilities (most of them are deposits). The hundred of assets produces a return of half a percent but on you know on five of equity that's 10% return (20x 0.5%) they're massively leveraged.

This week the chief executive of standard charted described his rating on his shares as crap.

I think what he should go and reflect on is that the return on Capital employed at standard charted is 5.7%. Now if the return on Capital employed is 5.7%, I don't know what the cost of capital, but Julian and I when we were growing up as Brokers were taught that if you don't know the answer to anything it's 10%.

In very round terms that's about half that so it's about half that and the price to book so the share price divided by the NAV per share which is your tangible Equity equals about 0.5. It's about right, he's making a return of about half his cost of capital and the Market's telling him that his bank is valued at about half its tangible Equity or on that asset value it's about right.

I have news for a lot of people, share prices follow the fundamentals of companies, not the other way around. We've never really found an example of something which had a high or a low share rating and as a result the company improved or deteriorated we found lots of examples where the company's fundamental performance eventually was reflected in the share price so if he wants to improve the share price.

Fundsmith is good at identifying buying decisions but how good are you at selling? do you track sold positions after they've left the portfolio against a random sell decision to see whether the fund make sales at the right time rather than simply to free up capital for a better buying decision?

Secondly given the higher than usual exits in PayPal Adobe Amazon do you feel these mistakes happen because you went outside your comfort zone and then what is the main rationale behind selling Amazon shares?

First of all for PayPal, Adobe, Amazon, Ester lauder, we do actually spend a lot of time and effort and emotional capital thinking about things that we could do better. Nobody's ever perfect.

The Irish uh coach who said um you got to be able to deal with the highs and lows of the game that is the game it's not about perfection it's about how you react to things same with us we'll never get this perfect it's one of the things that you carry with you when you do this job

-Andy Farrell

What we can do though is do it better, react to the things that come up and do it better. We do look at ourselves and if we look at those four cells, two have gone really well and two which have gone really badly at that point.

The difference basically and even within them we could have sold the PayPal and Ester lauder a bit earlier I think and done even better in that regard. There wasn't a common theme.

When you're thinking of selling something even if your reasoning is right and I think our reasoning fundamentally in Adobe and Amazon was right if you can see an enormous Tailwind going on in for some reason even if it's a very spirous Tailwind don't do anything sit on your hands for a while, you just have to.

The way that we try to define a good company is is is in respect of what the numbers look like how the company makes its money and whether we can understand what I call the simple path to growth and so if you take in if any of you own a small business which I'm so sure some of you do 10, 20 years ago you used to do your accounts via receipts or maybe on an Excel spreadsheet if you were particularly Advanced and it doesn't seem to us to be particularly outside of our comfort zone in terms of understanding that a small business do their accounts that way might as people become more uh technology literate and want to get more organized that they might actually want to use a QuickBooks product.

I think we would push back at the premise of the question um that these were outside of our comfort zone.

‘Any year that passes in which you don't destroy one of your best loved ideas is a wasted Year.’

-Charlie Munger

Terry with 14 years of Fundsmith under your belt what investment ideal investment belief have you changed your mind on, which you think has been to the benefit of the fund?

I can't think of the one at the moment I've changed my mind on it's the benefit of the fund but I've sort found a bank that we like now. As you probably know we both were Bank analysts in our youth and we've got a very long list of reasons which we've written down and published and waxed lyrical on about why you should never own Banks.

We found one we like and I'm sitting there at the moment wondering what to do about that. You know in the event that we buy it I am going to quote the great Warren Buffett.

Sometimes a man must Rive as above [Laughter] principle.

-Warren Buffett

If it's an investment that we have a high level of certainty will work for reasons that we won't go into now because we haven't bought the thing yet, and we may never buy it, I don't know.

People whose main problem in life is that the old ideas displace the entry of new ideas that are better, he says and then he goes on to say now it's a good thing that we have that problem in marriage that may be good for the stability of marriage that we stick with our old ideas but in most fields you want to get rid of your old ideas.

I think we've all known about some fund managers that really fall in love with their companies they almost treat their companies like their children um and if you try to persuade them to to sell one of their companies uh it's almost like trying to persuade them to sell one of their children.

There are certain dangers especially get when you get to a certain size so you you get to know the chief executive, you have his or her email you get to the CFO you know they know the name of your kids and you get very cozy with them and it becomes tremendously difficult to actually extricate yourself from what might not be the right financial position for the fund.

I think we have actually been good at that and as very simple evidenceal though we like to go on about the number of stock, the average length of holding period, the amount of time we've the number of stocks that we've held for a long period of time, I think on if you take the number of stocks that we owned either on the first day in November 2010 or in the in the year afterwards that was probably a number in the high 20s and only five of those are left.

We have over time engaged in a certain amount of rotation. It should be somewhat comforting, we are very aware we don't really want to sort of get to know our chief Executives by their first name or anything like that. The shape of things has changed over time in the portfolio and I think will continue to change probably over time and it does reflect that if you look back to 14 years ago half the fund was in consumer staples.

We're in the 20s, it's about half that and that is a reflection of the fact that we found other things but it's also a reflection of the fact that we become increasingly aware of the problems consumer staples have faced which have grown in some cases over time and are perhaps still growing over time we look at our ideas and see whether they still persist and ditto with things that we said we wouldn't own.

A while ago, we were pretty anti-investing in drug companies and we had lots of reasons why we didn't like the the kind of outcomes for drug companies in terms of the drug Discovery process and how badly it was working uh out there. Then we bought Novo Nordisk.

Fair to say that if you read the biography of Warren Buffett there's a moment in 1998 when Charlie Munger says to Warren Buffett that Coca-Cola is on 40 times earnings and that he should consider selling it and I think Buffett calls it one of his inevitables.

I think the lesson is that Charlie Munger did not fight a battle but was always getting at Buffett to actually think about these sort of thing. I didn't make it up because we didn't prepare anything for this but there's a wonderful quote from Buffett about coca cola.

Every year some you know upstanding well-qualified you know this one financial analyst or commentator says coca cola it's all over you know nobody wants fizzy you know sort of drinks anymore nobody wants flavored colas anymore and valuation is too high and got to sell it and you think yeah that's very sensible and he says look how it's done then he points out that it's a quote from forbes magazine in 1929

Unlike some people who seem to think they got it all figured out immediately, if you read the annual letter you'll see that one of the things I pointed out obviously we've got early interest in in shares in AI. Nvidia being the most obvious um but also quite a lot in in others some of our stocks like Microsoft and Alphabet some of the others that we sold like um Adobe and so on and Intuit.

If you look back to the early leaders in other sectors of tech over the last 30 years could you rely upon picking up the early leader and just running with that. Well Intel in microchips struggled quite badly in recent years/ Intel with an attempt to be both a designer and a manufacturer of chips.

AOL America online in internet service providers the entire concept doesn't exist anymore it's basically we're talking about telecoms company.

Nokia in Mobile phones

Yahoo in search engines obviously Google is now it.

Blackbery, was researching Motion in smartphones.

Myspace in social media. Myspace was there before Facebook all of them lost the position.

Basically so we really don't feel that we, probably anybody else, is at this stage able to pick winners for you and in any event just to be going on from there we're not even convinced there's going to be a winner from the whole theme.

One of the people when we were a bank analysts that we most admired as a manager was the late sir Brian Pitman who was a great manager thought at Lloyd's bank and who steadfastly refused to do what other Banks were doing which was take part in The Big Bang race to own Brokers and jobbers and Merchant Banks and when asked to explain this he had a number of things that he said but one of them was he said some markets don't produce any winners and he was absolutely right.

I think about that and it's the same with this maybe there won't be a winner from this. Maybe that won't emerge in any case, we don't yet know how the business model will work if at all for large language models and AI and what it would do so well.

We know that there are models and we know that there are people who are building those like open Ai and we know that they that they're being installed and put out there into the market by people like Microsoft by co-pilot and so on but when people get terribly excited about something like Adobe and send the price up 40% because yeah this is great it's won't they get charged for the AI.

I mean so they don’t own the model and they're not even supplying it in the first instance, that's going to come from somebody like Microsoft supplying the operating systems. Nobody has yet defined how Adobe will make another scent from its customers by supplying this.

If everybody's got it, nobody's got it.

There may be no competitive Advantage if everybody's got it the the analogy which I borrowed from Warren Buffett and elaborated on. He uses a street parade for his example I use a football stadium.

You know the striker runs into the penalty area with the ball that the second row stand up so they can get a better row over the front row and 30 seconds later absolutely everybody in the stadium standing up nobody's got a better view than there before they're just less comfortable and maybe all we're going to get here is is something which goes out into the world which does provide a product enhancement in in a number of areas to uh consumers and businesses but nobody net makes a great return out of it.

It'll probably be a long time before we're confident that we know who the winners are if there are any you look like you're going to say something here I was just going to say that although it's quite hard to identify the winners one thing that you also need to do is to think about the losers.

Even though there are sometimes no winners there's almost always some big losers! If you were to say who have been the benefit who have been the beneficiaries of the internet well it be hard to say but I mean presumably people who were sort of printers or who did classified advertising probably didn't who have been the beneficiaries of digital photography hard to say but Kodak probably wasn't a a great thing who's been a benefit of digital money hard to say but presumably if you printed cash um that's not very good.

I mean one of our things is not only to try and play offense but also play some decent defense.

I'd like to know why the fund continues to hold positions in some long-standing underperforming companies, in particular referring to Unilever which never seems to have got over its mayonnaise Mission?

When we're looking at those holdings on the Bloomberg and something that's been underperforming I say ‘it's a a gift that keeps on giving keep giving gift that keeps on giving’. We do sit and think, worry about this.

We continue to own it is because we think the company's okay it's the management that was the problem. We can change management and indeed they have change management so let's explore that for a moment.

This is a strong business, an easy way to represent things to you, Returns on Capital employed, gross margins, operating margins, cash conversion, growth rates…

If you just do, searching for those numbers, you start to understand why the business is capable of producing good numbers. If you don't understand that it may stop doing it in a moment for a reason you don't understand.

Unilever has 14x 1 billion Euro Brands. That is 14 of the top 50 brands in the world in fast moving consumer goods. It has got 3 brands with over 4 billion euros: Dove in sales Dove, Knorr and Omo. 3 brands with sales between 2 and 4 billion Rexona, Wall’s and Hellmann. 8 Brands over a billion.

This company much more powerful brands in our view than some other companies that do better. How about distribution and things like that?

It's got 61 billion euros in sales, it's got 59% of its sales in Emerging Markets which an awful lot of people will tell is a critical source of growth. In this area you know it's top five markets are the US, India, China, Brazil and Indonesia, three of those are the world's top three democracies right in there it's quite interesting I think for you

3.4 billion people around the world use Unilever products every single day. Half the world's population picks up one of these things, so we've got a very strong brand portfolio in a business with very strong distribution handicapped by management

Here's a few examples of the handicaps:

Reorganizations in 2010 they announced their Unilever sustainable living plan 2016 we had connected for growth obviously someone hadn't lost their sense of irony in coming up with that one.

Iin 2022 we went for the Unilever compass strategy for sustainable growth right.

Really good businesses don't do this stuff they don't keep reorganizing constantly and they certainly don't think that Snappy titles are the answer.

How about their strategy in terms of organic growth versus Acquisitions in 2014? We were told it was Bolton Acquisitions between 1 and2 billion EUR some of which were disastrous Dollar Shave Club for example which was a billion Euro acquisition which disappeared pretty much without Trace but in January 22 we switched Tech and they were going to go for a big one they came and said that they wanted to buy the GSKs consumer business which is been spun out as the over the counter medicine's business for 50 billion.

I haven't looked up the market value because they didn't get it, but when I last looked it was about 30 billion pounds. It would have been a disastrous destruction of value.

Now we're on organic growth under the new management which by the way I think is the right strategy.

How about names so one of their divisions went from being personal care to beauty and personal care to beauty and well-being? how did that help exactly um uh one of the divisions went from being SA dressings and spreads to foods to food and refreshment to nutrition.

Anyone think any of this helps really a focus on selling more stuff to more people might have been what they should have gone for you would have thought you know and what did this lead to in financial performance here's a table that just shows a few metrics over the years 2008 as a point 2018 and 2023.

The return on invested Capital you can see back here was 15.7%, did have a bit of a lift but now that's basic flatlined, gross margin was 47% then it was 43 then it was 42, this margin which we say is the big protection for import cost inflation down operating margin did have a tick up.

Now below that level so these metrics are poor I would say that's an inadequate return and and deteriorating sales growth in the Years 2009 to 2018 so the years here were 2.2% pretty anemic frankly and then in 2018 to 2023 0.5%.

What a bad what a bad outcome for a company with such strong Brands and such good distribution. I haven't chosen or we haven't chosen those dates at random you know that was when Mr.Pullman became chief executive and that's when Mr.job took over basically and that's what you got I'll leave you to judge whether you think that was a good outcome or not.

We think this is basically a potentially very very good business that's just not been managed properly.

We continue to hold positions in some long-standing underperforming companies, he's right but if you take the companies that we've owned since Inception which you which have certainly performed less well than the fund we've got Philip Morris International which is done nearly 10.5% p.a, Diageo just over 10% p.a, Pepsi's done 11.5% p.a, Unilever has actually done 9.7% p.a, whereas some of the things that we've booted out along the way so Colgate, Kimberly Clark, 3M, Imperial Brands, Reckitt Banckiser, Nestle, have all done significantly worse.

For a consumer company to compound at 10 or 11% is not bad. I mean you're not going to get 20%, so I would say that I would push back again that I mean I know we've got Unilever but I think that our record in terms of holding on to longstanding underperforming companies is actually relatively good.

If you reflect and look further out, do you believe the brand value of consumer staples companies is getting impaired by the rise of private labels?

The latest data pointed out that own label brands are out selling well-known Brands. Private label is a complex subject in my view, a more complex subject than the simple ‘well people trade down to private Brands’ , just to show you some data on it private labels share by company and by category.

It's kind of interesting you can see low shares in own labor in things like toothpaste, beer, whiskey, chocolate, and this is an outlier, Frozen vegetable as it has been highly commoditized.

Basically if you put things in your mouth you're quite worried about whether it's good and if you put it on your baby's bottom you're less concerned funnily enough. In fact looking at the companies even if you put it on your own bottom you're less concerned because you look at the private label share by company.

Coca cola yeah obviously things you consume PepsiCo Colgate things you consume, Kimberly Clark tissues and so on very high indeed um and obviously it's not just the fact that you consume these and you do care about what you put in yourmoth. It's also the fact that they they are companies with very powerful Brands out there and so it's not that there's a uniform share of private label either in companies or in categories it varies it depends where you are in the market.

The other thing about it is when people trade down, which you know quite a lot of people have have been forced to by the the inflation that we've experienced in the last few years to change their choice, sometimes you change the retail venue you know you go for buying something not in Waitrose but you go and buy at an Aldi or Lidl. Basically sometimes you do stay with a brand you go with a cheaper brand.

Tide Pods are a premium price brand but if you go to Oxyclean which is a Church and Dwight brand you get a pretty good result so you go to that. Name label is one of the choices but it's not the only choice that people have got.

Lastly we've got some actual data here because the question was about have they grown in recent times and are they more of a threat than usual. One of the companies in our portfolio is Church and Dwight and they helpfully produce quite a lot of data on private label and you can see here we've got data for the last 10 years from them on pregnancy testing kits, baking soda, gummy, vitamins, toothache medications, clumping, litter and mouthwash.

I would suggest you that this shows a number of things one is private label isn't actually gaining there isn't any sign of that with within these categories. Secondly my thing about things you put in your mouth being pretty safe would appear to be the case. things for toothache and finally pregnancy texting kits have got a very high percentage of own label and we've always puzzled about that and I think it is if you're getting pregnancy tested you're a bit worried about being pregnant getting a cheap one means that you might get the wrong result and you'll feel a bit cheerful what do I know so I think it's a bit more complex.

You selected meta as the portfolio company with the most upside potential, which portfolio stock would you select this year?

um so just to say that when we were sitting here last year we were coming off a year when we had some some big drops in a lot of our companies.

Microsoft was down had be down 29% in 2022, Apple was down 27%, Alphabet was down 39, Coloplast was down 29% even L’Oreal was down 20% and meta was down 64%.

One of the things that we always say is, if you're not excited if you're not most excited by the things that have fallen the most then why are you still owning them, so there was a certain almost logic in us saying what we actually did um in as we sit here today we're obviously coming off a year when a lot of those things have recovered very significantly so I think the first thing is that the for 2024 itself as a 12-month period I doubt you're going to get the same percentage increases as you have done.

I think for the first time ever the the the portfolio company of the most upside potential I think could well be Unilever because it is an unloved business, it's had all the issues we've been through but it looks in terms of its rating and in terms of the potential and in terms of the things that the company is doing it looks to me to have quite a lot going for it so I'm going to go with either that or Mettler-Toledo which happened to be the worst performer in percentage terms over the last year.

(Terry to Julian) It is a very good business, I agree with him um just to elaborate on that slightly on Unilever, apart from the fact that it's lowly rated and has clearly had these issues with management changing the names of things and reorganizing things and all those kind of things, the new management team seems to us to be grasping things quite well and in particular laying out that they want to become the best version of what they are that they could be which sounds slightly but it's like benchmarking what they are in terms of the food business and the household cleaning products business and the personal care business against the best other performers in the market and getting to that level before buying and selling things largely and I think that's exactly what they should be doing basically so I I think we we obviously wish them well because we're still a shareholder and I think that they're showing very good form.

(For Julian) At last year's meeting you suggested Adyen as a business of interest that fundsmith would like to buy but it was too expensive. Since then its price has dropped by over 50%, what's the reason for the decision not to purchase at a more attractive valuation and is it still in the investable universe?

So one of the things that we say that we look for in terms of of buying a stock that's in the investable universe but not in the portfolio Terry uses the word ‘a glitch’ and I think that a glitch has two characteristics:

Something has caused the share price to fall quite significantly which gives you your valuation or pricing opportunity

The market thinks it's a real problem but actually underlying nothing has changed

I think the problem problem we had with Adyen is that something had changed. I mean

The business was growing at 50 to 100% before covid and is now slowed down quite considerably so I mean there's certainly reasoning why Adyen should be cheaper,

The payment space as evidenced by people like PayPal and no they don't do the same thing as PayPal, but as evidenced by PayPal has become I think more complicated

A glitch normally takes the share price down say 10% to 20%. The share price fell 77% which is in a day about which is kind of alarming and makes you uncomfortable.

I mean in the short term the price went from 1,300 to 600 and is now back to or, 1400 to 600 and is now back to where it was before it's quite amusing actually it's one of those stocks that if you if you were here last year and you looked at the share price again today you wouldn't think that anything happened in the course of the year but I think that something has happened so it does remain in the investable universe.

We continue to track it hopefully as we get to know it better and better and if another opportunity like this comes along we might bite.

I think one of the fundamental things that struck us when we were looking at the announcement that um led to the very very sharp share price for was whether or not in our original thinking we had underestimated the ease of relatively frictionless switching it's at the in the payments business it's at the merchant acquiring end of it.

When you pay with something the store whatever/supplier has to get their money into their bank account and has to go to a merchant acquirer and often a bank to get the the transaction process basically. That's a area which is quite low margin so you know little bit worry about if anything goes wrong when you're on low margins.

First, a lot of people are multi banked and the friction involved in switching was low and until we have an answer to these issues, it doesn't get into the ‘ yeah we definitely want to own this business’ Camp.

Love their slogan: ‘Buy good companies. Don’t over pay. Do nothing.’

I owned Fundsmith for many years and it survived the 2022 bear market, recovering well. Smithson Equity Trust (SSON.L) did not: I lost a lot of money and bailed out of both in favour of Alpha Picks quant portfolio.