The Path

Kevin Daly was not destined to become one of the best investors of our generation. He started his path in 1975 getting his civil engineering degree at UC Berkeley.

Daly’s first job and as it only job prior to launching his hedge fund—was with Hoefer & Arnett, a boutique brokerage and investment-banking firm. After a quick period as a broker, he became a research analyst.

After 15 years, writing equity research and managing his own capital, he opened up his own fund called Five Corners Partners, L.P with $3 million(1/3 own capital), which he still currently manages with about $100 million in assets under his management of which he remains the same percentage off.

Daly created the fund to allow for a structure where some individuals could co-invest, however the best description would be one of a private investor, managing the fund as a solo enterprise from his home office. Kevin Daly is one of the traders, like Ed Sekoyda that seems to have perfectly integrated trading and investing to live his life exactly how he wishes.

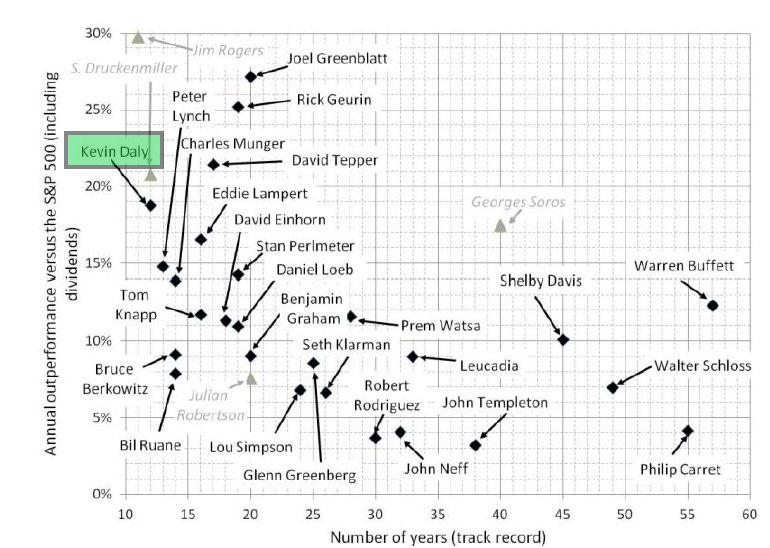

Over the 23 years he managed his funds, he returned ~ 2,550% or a 15.12 CAGR. His performance would have turned $1,000 into $25,500 over that period.

Perhaps, the most impressive trait about his performance remains the control of losses. Even prior to opening his fund, Daly only had one losing year, 1994!

During the 23y he ran his fund, the only losing year remains 2008 with -7.5% as the market crumbled -50%.

Five Corners Partners performance

The Philosophy

Daly seeks out companies that are selling well below the intrinsic value of their business.

Although Daly did some shorting during his career, it played a relatively minor role, usually accounting for less than 10 percent of assets under management. As of 2022 his net long exposure was 26.3% through a long exposure of 30.7% and a short Exposure of 4.4%.

In this context, Daly’s investment approach is close to a long-only fund. If he feels like valuations or the market do not reflect his view, he will often go to cash rather than try and short.

Throughout the fund’s life he has been looking for companies that are somewhat obscure, not covered by Wall Street, or have a niche business inside the company that no one is focusing on. He uses the size of the fund to his advantage and tries to find value where no-one is watching, no need for unneeded competition.

The size of the asset does not matter to him, what does is the value it presents through its dislocation from intrinsic value. His investment universe is composed of 10,000 stocks through his agnostic approach which allows him to be picky.

To stay away from trouble, he watches various economic statistics, including more esoteric data such as weekly rail car loadings. When the data points to a slowdown, he might reduce his exposure which he did in 2002, 2008 and 2010. To him, a missed opportunity is always better than to lose money.

As he puts it, the main aspect that allows him to protect his portfolio is the asset type he buys:

‘It’s also the type of companies that I buy—companies with good balance sheets and solid free cash flow. I’m always trying to buy a dollar’s worth of assets for 50 cents, which helps limit the downside.’

The process

Kevin Daly uses a scanner to allow him to quickly and efficiently filter out the weeds. He focused on a few distinct metrics that provide him with insights over the companies value.

EV/EBITDA

P/FCF

P/E

EV/EBIT

For Banks and financial institutions, the focus changes as the accounting changes. On this side, Daly uses the following:

P/TBV

P/E

Tangible common equity/total assets

His goal is to find businesses that are cheap and return value to the shareholder. Once his screening process is done, he is left with 200 businesses to chose from.

The Qualitative assessment

The most important aspect, now that he knows the businesses is most likely cheap, is to filter out those that are too complicated. A businesses, at its core should be clear to understand. The focus is put on companies he is familiar with and extremely cyclical businesses as companies with unpredictable product life cycles such as biotech or technology are put aside.

Too steer clear of value traps, Daly tries to stay away from businesses that can’t grow their free cash flow and intrinsic value.

‘if I invest in a business that can be purchased at a discount to its intrinsic value, and that value is growing, then all I have to do is wait and be patient.’

He also looks for buyout candidates due to their market share, intellectual property, distribution network, or real estate value.

A hidden truth is hidden behind this statement, Daly mostly looks for companies with long runways.

‘A good business is one that provides a necessary service or product and has a balance sheet and cash flow that can sustain it through difficult periods.‘

-market wizards hedge fund page 188

Once he finds these businesses, the true reading work starts. He will often start with research papers or analyst reports. It helps him with understanding the background, playing field, the competitors and alike.

Only buy businesses you understand.

Buy $1 for $0.5.

The goal is to receive $1 back, nothing more.

Market crashes provide the best deals.

Do not waiver from your process.

Buy businesses, not stocks.

Take advantage of my partnership with my only broker CenterPoint

Insurance Auto Auctions (IAAI).

Here is an example of an investment thesis and trade he took.

In a recent report on the auto auction industry, Kevin Daly came across an interesting comparison between two major players: Copart (CPRT) and Insurance Auto Auctions (IAAI). Despite both companies sharing a common business model of acquiring wrecked cars from insurance companies and auctioning them off to buyers such as salvage yards and auto body shops, there was a noticeable disparity in their profit margins.

IAAI's margins were significantly lower than those of CPRT, which prompted Kevin to investigate further. After meeting with IAAI's management and conducting extensive research, Kevin could not find any reason why IAAI's margins should not increase to match CPRT's levels.

Kevin saw a clear investment opportunity and started purchasing IAAI shares at around $15 per share, buying all the way up to $22 per share. This investment proved to be fruitful within a year, as Kelso, Inc. acquired IAAI for $28.25 per share.

What made this investment even more attractive was the stock's valuation, with a free cash flow yield of over 10 percent and a forward EBITDA of just over five times.

It is the combination of a cheap business, a mispricing and thorough research that led to this almost 100% trade.

Closing thoughts

When the price closes the gap between the undervaluation and fairly valued, he will close out the position. In essence Kevin Daly’s strategy is buying a dollar with 50 cent and repeating the trade over and over again. Kevin’s strength lies in his ability to mitigate losses, he keeps it simple and tries to find bargains within growing businesses. His assets size allows him to partake in smaller, less known companies and avoid competing with the biggest on wallstreet

Great post 10/10* appreciate it!

Really enjoyed this post. Thanks for sharing.